Suppose You Consider Buying a Share of Stock at $40

According to the capital asset pricing model. The stock is expected to pay a dividend of 3 next year and to sell then for 41.

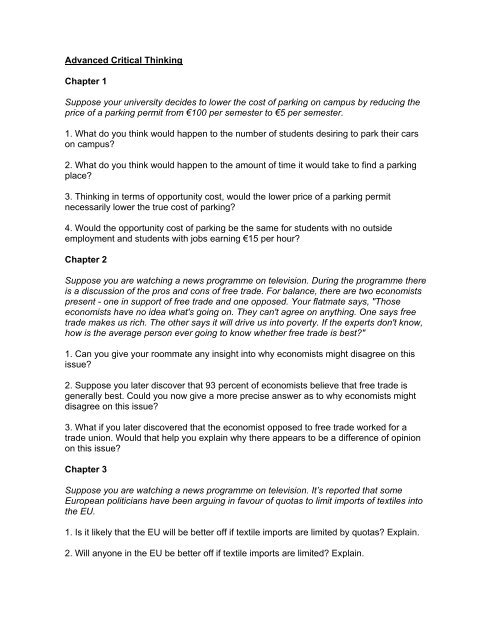

Advanced Critical Thinking Chapter 1 Cengage Learning

What would be the expected return on a zero-beta stock.

. Buying a call and a put B. The stock is expected to pay a dividend of 8 next year and to sell then for 98. The stock is expected to pay 3 dividends next year and you expect it to sell then for 41.

Suppose that put options on a stock with strike prices 30 and 35 cost 4 and 7 respectively. The stock is expected to pay a 3 dividend next year and you expected to sell the stock at 41. Is the stock overpriced or underpriced.

Buying a call option investing the present value of the exercise price in T-bills and selling the underlying share is the same as. Suppose you consider buying a share of stock at 40. Suppose that a European call option to buy a share for 10000 costs 500 and is held until.

The stock is expected to pay 3 dividends next year and you expect it to sell then for 41. Suppose you consider buying a share of stock at 40. The stocks systematic risk has been evaluated to be β-05.

Suppose you consider buying a share of stock at 40. 35-strike put with a premium of 153. Using the SML calculate the fair rate of return for a stock with a β -05.

The stock is expected to pay a dividend of 3 next year and to sell then for 41. The stock risk has been evaluated at B. Is the stock overpriced or underpriced.

The stock is expected to pay 3 dividends next year and you expect it to sell then for 41. Buying a put and a share C. According to CAPM expected return should be 1 5 x 15 1 8 The correct price should be 41 PP 3P 8 P 4074 Since the stock is current selling at 40 per share the stock is underpriced.

The stock risk has been evaluated at β -05. Is the stock over valued or under valued. Using the SML calculate the fair rate of return for a stock with a β 05.

The stock risk has been evaluated at β 5. C Suppose you consider buying a share of stock at 40. Suppose you consider buying a share of stock at 40.

The stock is expected to pay 3 dividends next year and you expect it to sell then for 41. FINA410 Financial Markets Investments c. The stock is expected to pay a dividend of 3 next year and to sell then for 41.

Buying a put D. Suppose you consider buying a share of stock at a price of 40. The stock risk has been evaluated at 5.

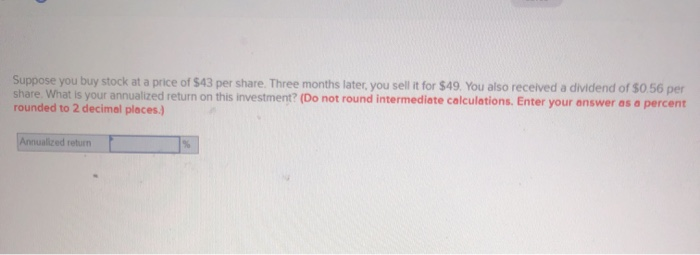

Suppose you consider buying a share of stock at a price of 95. The stock risk has been evaluated. -Fair Expected Rate of Return E 5 05 12 - 5 85-Actually Expected Rate of Return E 41 3 40 - 1 010 10-Because the actually expected return exceeds the fair return the stock is underpriced.

What would be the expected return on a zero-beta stock. 45-strike put with a premium of 575. The stock is expected to pay a dividend of 3 next year and to sell then for 41.

The stock is expected to pay 3 dividends next year and you expect it to sell then for 41. Suppose you consider buying a share of stock at a price of 40. What would be the expected rate of return on a stock with β 0c.

Suppose you consider buying a share of stock at a price of 40. The stock risk has been evaluated at5. Suppose the stock price is 40 and the effective annual interest rate Suppose the stock price is 40 and the effective annual interest rate is 8.

Using the SML calculate the fair rate of return for a stock with a β -05. Suppose you consider buying a share of a stock at 40. Suppose you consider buying a share of stock at a price of 40.

Selling a call 5. Suppose you consider buying a share of stock at 40. Is the stock over or under priced.

This generates a profit in all circumstances. Suppose you consider buying a share of stock at 40. What would be the expected rate of return on stock with a beta of 0.

Stock is Overpriced Underpriced Correctly priced. Suppose also that the expected rate of return required by the market for a portfolio with a beta of 1 is 12. What would be the expected rate of return on a stock with beta 0.

The stock is expected to pay 3 dividends next year and you expect it to sell then for 41. Suppose you consider buying a share of stock at a price of 40. The stock risk has been evaluated at β 5.

The stock risk has been evaluated at β-05. The stock is expected to pay 3 dividends next year and you expect it to sell then for 41. The stock risk has been evaluated at β 5.

The stock is expected to pay a dividend of 3 next year and to sell then for 41. The stock is expected to pay a dividend of 3 next year and to sell then for 41. Suppose you consider buying a share of stock at 40.

The stock risk has been evaluated at. The stock risk has been evaluated at β -5. The stock risk has been evaluated at β 5.

The stock risk has been evaluated at β 5. The stock is expected to pay 3 dividends next year and you expect it to sell then for 41. Suppose an investor buys one share of stock and a put option on the stock and simultaneously sells a call.

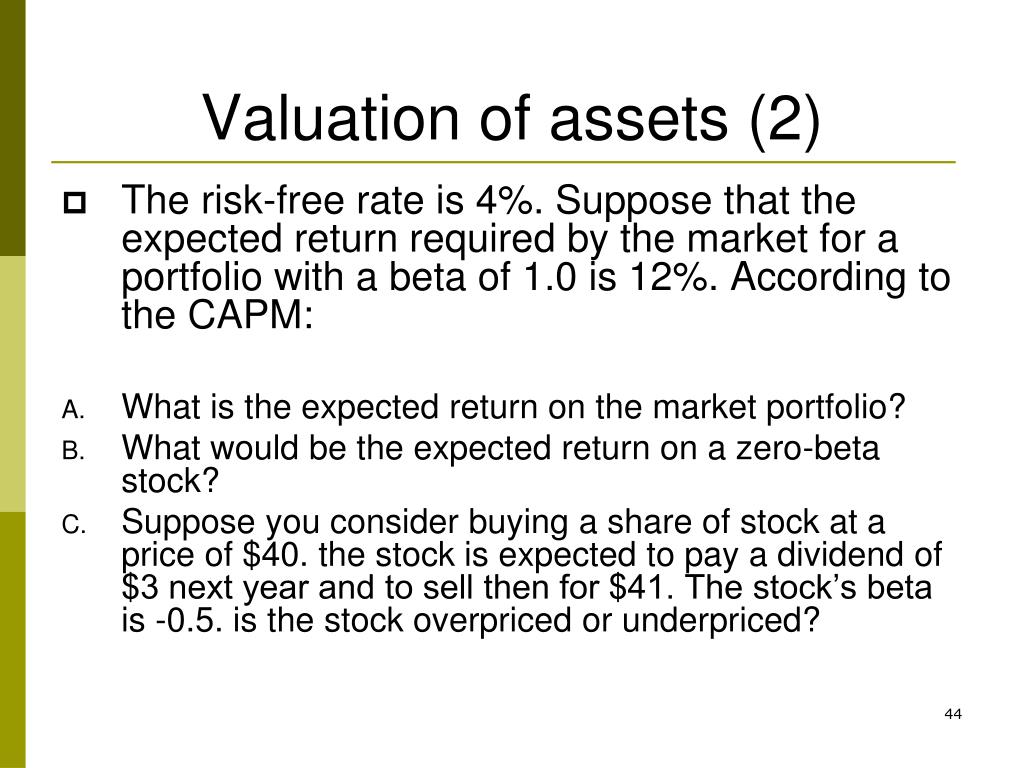

Draw payoff and profit diagrams for the following options. Suppose the expected return required by the market for a portfolio with a beta of 10 is 12. Expected return on the market portfolio is 12 and expected return on a zero-beta stock is 4.

Suppose you consider buying a share of stock at a price of 40. Month buy the stock and buy the put option. The stocks beta has been estimated at beta-05.

The stock is expected to pay 3 dividends next year and you expect it to sell then for 41. The stock risk has been evaluated at β -05. 40-strike put with a premium of 326.

The stock risk has been evaluated at β -5. Suppose you consider buying a share of stock at 40.

Your Company Has Earnings Per Share Of 4 It Has 1 Million Shares Outstanding Each Of Which Has A Price Of 40 You A Homeworklib

Financial Institutions Management Solutions A Financial Institution Has The Following Market Value Balance Sheet Structure Pdf Free Download

What Is Short Selling Definition Advantages Dangers

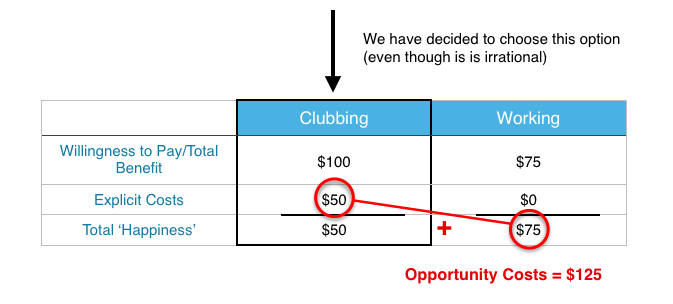

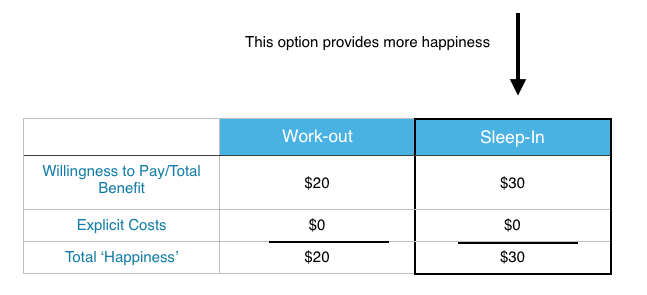

1 2 Opportunity Costs Sunk Costs Principles Of Microeconomics

Marty Sereno Political And Anti War Links Blog Diary

Solved Suppose The Call Money Rate Is 6 8 Percent And You Chegg Com

Advanced Critical Thinking Chapter 1 Cengage Learning

1 2 Opportunity Costs Sunk Costs Principles Of Microeconomics

Busfin 4221 Investments Flashcards Quizlet

Your Company Has Earnings Per Share Of 4 It Has 1 Million Shares Outstanding Each Of Which Has A Price Of 40 You A Homeworklib

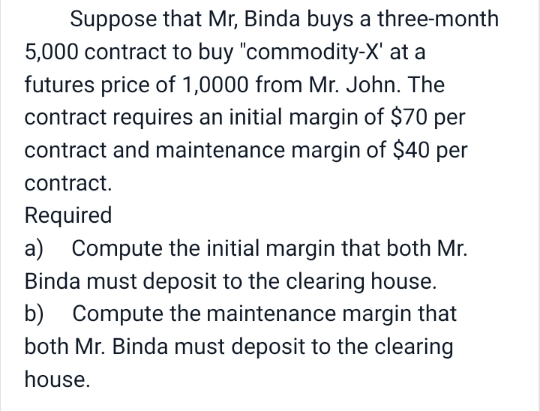

Answered Suppose That Mr Binda Buys A Bartleby

Chapter 7 Finance Flashcards Quizlet

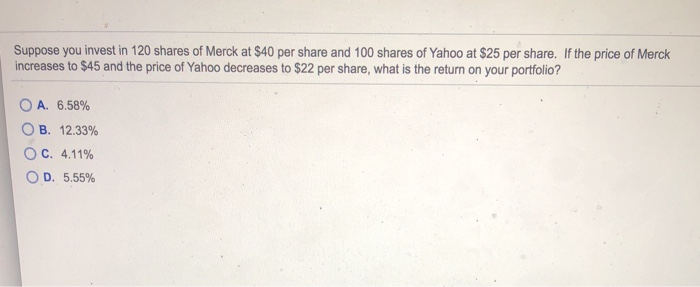

Solved Suppose You Invest In 120 Shares Of Merck At 40 Per Chegg Com

Marty Sereno Political And Anti War Links Blog Diary

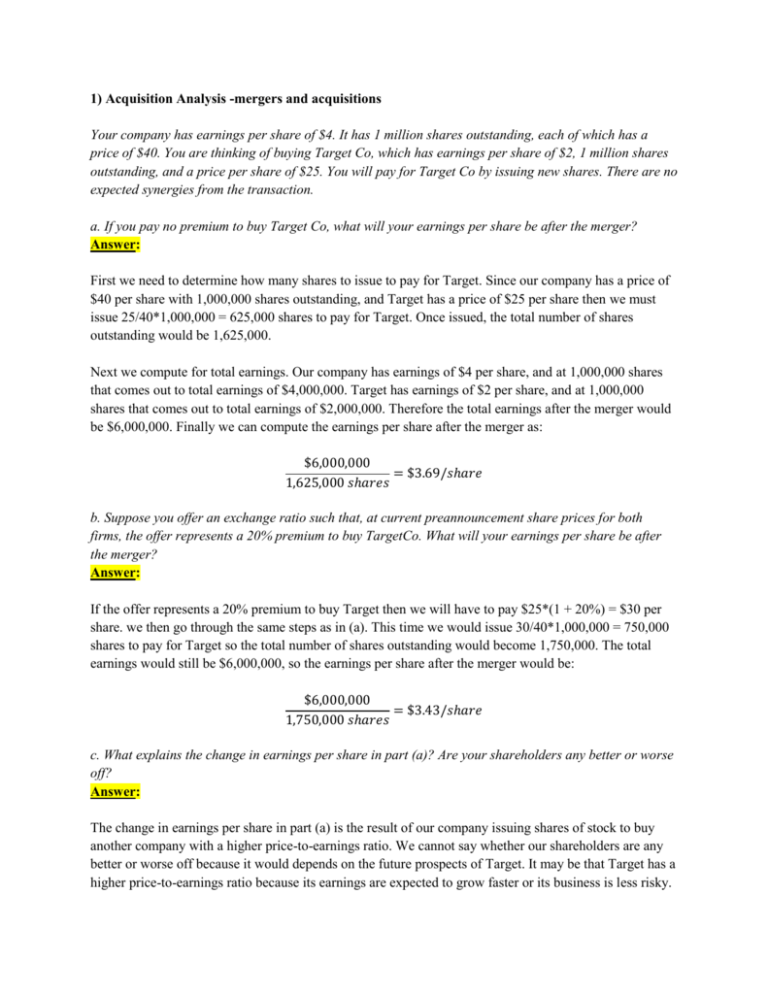

1 Acquisition Analysis Mergers And Acquisitions Your Company

Ppt Finc4101 Investment Analysis Powerpoint Presentation Free Download Id 326710

Comments

Post a Comment